Conventional mortgage in Mexico for international buyers

The digitally-processed mortgage loan with greater flexibility, speed, and simplicity in Mexico.

Mortgage

Advantage

Intrigued? Take the next step and click here to pre-qualify for this amazing opportunity!

Pre-qualifyPre-qualification in minutes.

Rates from 10.60% to 11.18%, based on term and capacity, not on risk level.

Credit score:

- No commitee: 725+

- With commitee: 689+

Jumbo loans for salaried employees up to 90% of capacity.

No account opening is required for direct debit.

Must be resident in Mexico with income from abroad.

Product

Characteristics

- Minimum from $500,000 Mexican Pesos

- Minimum home value: $1,250,000 Mexican Pesos

- LTV 85% for employees and 65% for self-employed

- Amortization up to 30 years

- Opening fee of 2%

- Life insurance: 1.0% per thousand

- Property insurance: $0.4 per thousand

- Administration fee: $399 + taxes per month

Flexibility

No medical study is required

No medical study is required

The co-borrower does not need to be related to the borrower

The property can be in restricted areas, with purchase through a trust (fideicomiso)

Characteristics of the Property

Located in consolidated urban areas

Residential or mixed land use (when it does not exceed 20% of the total construction)

Remaining useful life of at least 1.5 times the credit term as determined by an appraiser.

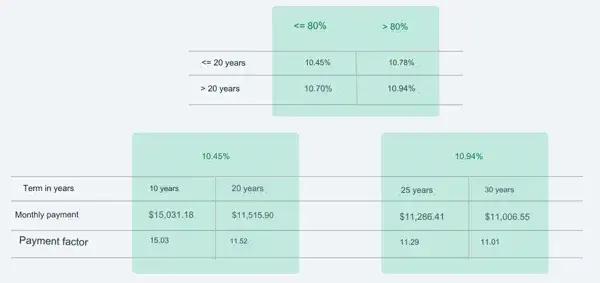

Interest Rates

Documents needed

Foreign salaried employee

- 18 months on the job (max. 6 months labor gap)

- Account statements showing deposits (last 3 months) + proof of employment

- Home country credit bureau with score and account details

- Permanent, temporary, or multiple migratory status

Foreign independent employee

- The last 3 months account statements

- The last 2 complete annual tax returns

- Home country credit bureau with account details